At the April board meeting, LHCC directors discussed a serious problem: they pledged the clubhouse (LHCC common area) as collateral for a loan from Wachovia without first obtaining owner consent. Several board members referred to this as a breach of their fiduciary duty, since common area can’t be mortgaged without first obtaining more than two-thirds consent of Lake Holiday’s owners and that consent was never obtained. GM Ray Sohl introduced the solution to this problem: “the board of directors has expressed an interest in re-collateralizing the existing clubhouse loan.”

The board’s solution: ask owners to retroactively approve mortgaging common area, and if approval were not obtained, to refinance the Wachovia loan at a great expense. Doing so would require paying about $18,000 in refinancing costs, paying approximately $20,000 more in annual debt service over 5 years, pledging 91 LHCC-owned lots, and allowing Wachovia to put a bank hold on $150,000 to $200,000 of LHCC’s cash. Add that up and you get a cash savings of $120,000.

That initial discussion of the problem was lengthy. Our nine video clips cover over an hour and ten minutes in Clubhouse Loan Pts 1-9:

By July, preparations were underway to put the re-financing to an owner vote. LHCC announced the upcoming vote on July 21st. At the July 28th board meeting VP Dave Buermeyer, guided by Wayne Poyer, proposed the specific language to describe the issue to owners. Right away he met with resistance from 2 board members, John Martel and Jo-anne Barnard. Martel claimed that the language gave the refinancing proposal an “air of legitimacy that it probably never really achieved.” Then, Martel did an abrupt about-face and retreated from that position when Poyer seemed to be bothered by his remark. Jo-anne Barnard called the referendum “meaningless” because despite the high cost, the board had already decided to do the refinancing even if owners didn’t approve it. Nevertheless, every other director was satisfied with the decision to proceed with the refinancing. Many felt no further discussion was necessary.

Barnard and Martel felt the significant cost of the refinancing did merit further discussion. Barnard corrected the cost estimate served up by Poyer and Buermeyer. She observed:

It doesn’t cost $20,000. It costs $20,000 and $18,000 in the near term every year at the same time that we have to do the dam.

Here’s the July discussion in clips Oct 08 Referenda Pts 1-5:

So what’s the biggest problem in refinancing the clubhouse balloon note to fix pledging the clubhouse without first obtaining owner approval? The clubhouse isn’t even pledged as collateral on that note. Either Poyer and Buermeyer weren’t being candid about their reasons for proposing the refinancing or they never even bothered to check the documents. If they had taken just a moment to read the collateral exhibit, they would have seen that it clearly contains a description of real estate that is not the clubhouse.

A cautionary word to the non-lawyers that try to comprehend an important legal document like the loan collateral exhibit: it’s a whopping 2 pages, and the description of the property used as collateral involves potentially hard-to-understand legal terms, such as “231 Redland Road.” Proceed carefully!

After watching the video of the July meeting, property owner Bill Masters did bother to check the documents, and the exhibit showing the collateral for the loan very clearly listed the collateral as 231 Redland Road, the location of Lake Holiday’s management office. Masters contacted GM Ray Sohl, and directors Barnard and Martel to understand how they missed this.

Sohl initially disputed Masters’ assessment and insisted the clubhouse was used as loan collateral. Masters had to show Sohl that the loan for which the clubhouse had been used as collateral was paid off and closed months ago. Keep in mind that Masters was making his argument to Sohl and several board members using documents he originally obtained from the Lake Holiday office in the first place.

Barnard and Martel were surprised by his claim but promised to investigate. To further support his contention, Masters supplied loan documents to Barnard and Martel and Frederick County tax maps, one of which appears nearby. In a few days, Sohl, Barnard, and Martel came to the same conclusion that Masters had: the clubhouse wasn’t pledged on the loan in the first place, so there’s no reason to spend all that money on the expensive refinancing supported by Poyer and Buermeyer.

The cash savings, as Barnard herself pointed out at the board meeting, is about $120,000 over 5 years. When Masters discussed with Barnard the significant cash savings, Barnard disputed her own number. Evidently, dollars that Masters saves don’t count as much as dollars that the board very nearly wasted. Beyond the cash savings, Lake Holiday retains clear title to its 91 lots and has unrestricted use of the $200,000 that it would have had to pledge to do the refinancing. Masters managed to accomplish all of this while holding down a full time job and not serving on the board.

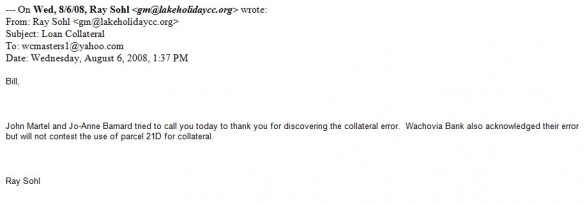

Barnard’s attempt to discount the savings is just evidence of the board’s spin machine revving up. More evidence of that is Sohl’s email to Masters, thanking him for catching the “error,” but pointing the finger at Wachovia for not securing the loan with the right collateral. Maybe Wachovia’s Mike Wilkerson has a different opinion of who owns the “error.”

Much can be learned from this episode to improve Lake Holiday. LHCC directors voted to spend over $120,000 of the organization’s cash based on the erroneous belief that the clubhouse was pledged as collateral, a belief that reading the loan documents would have quickly corrected. While Barnard and Martel were against spending money on refinancing, at a minimum they and every other director are guilty of approving a significant expenditure without bothering to read the underlying documents. That’s wrong. If any director did read the collateral documents and recommended the refinancing based on a claim that he knew to be false, that would be far more troubling.

When Masters first called Ray Sohl, he encountered far too much resistance. Sohl spent too much time defending the position that the clubhouse was pledged as collateral, perhaps because the board had already invested so much time to approve the refinancing. If the clubhouse were not pledged, it would make all the resources devoted to the refinancing an embarrassing waste. Fortunately, Masters took the time to make the phone calls and send the emails to overcome Sohl’s resistance. Masters was in an exceptional position because he had previously requested the relevant documents and closely followed the board videos, two things for which he is often unjustly criticized. But it shouldn’t be that hard for owners to get the management office to reach an obvious conclusion. While this went from start to finish in about 3 days, that was too long because the loan collateral exhibit was so clear and unambiguous. The initial response involved too much defensive posturing. If Masters had not persisted after receiving Sohl’s initial response, the savings may have been lost.

Fortunately, Masters saved $120,000 of Lake Holiday’s cash. What the community learns from this affair may be even more valuable.